MI Auto Insurance Reform

Everything You Need to Know About Michigan Auto Insurance Reform

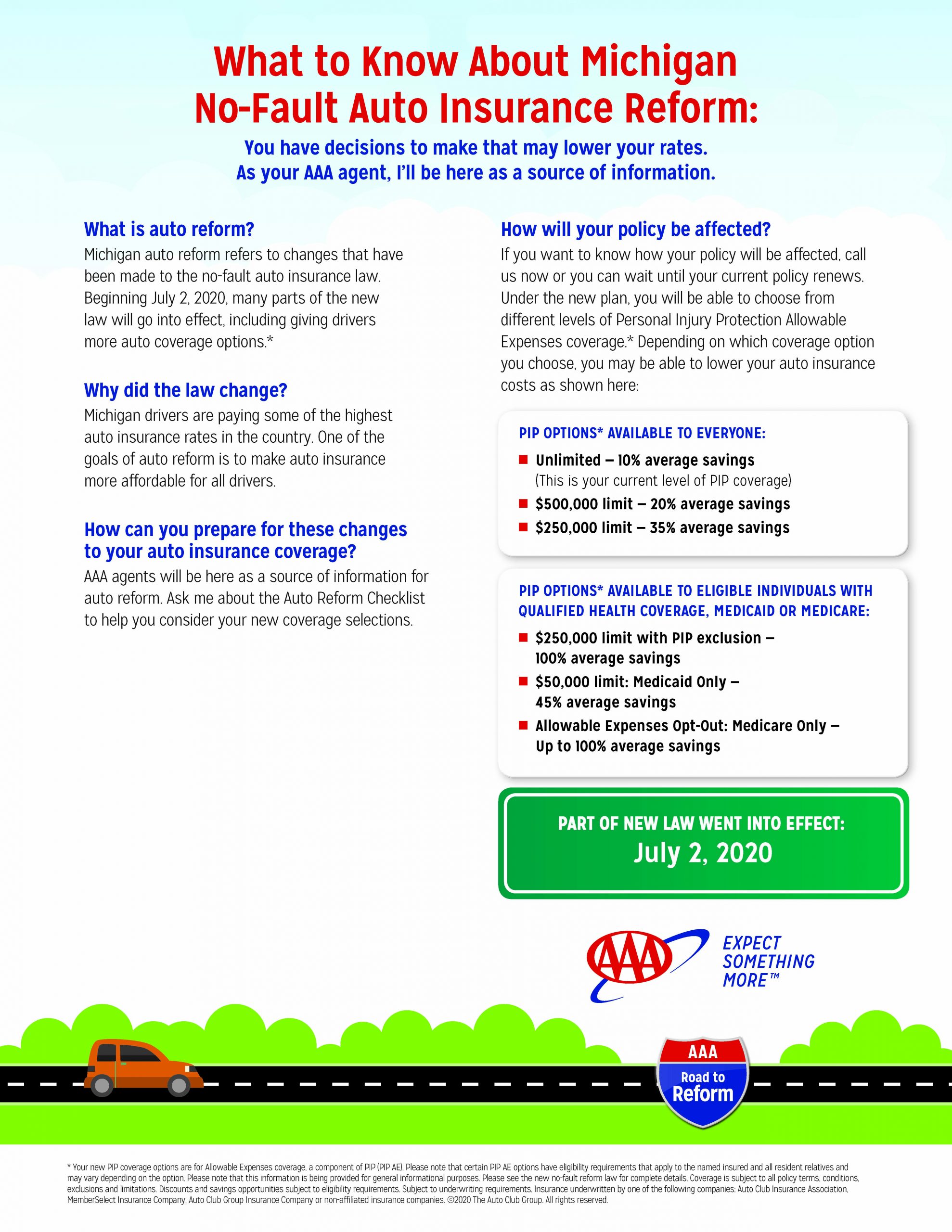

MI Auto Insurance Reform Overview

The State of Michigan passed historic bipartisan auto no-fault legislation to lower costs for Michigan drivers – while maintaining the highest coverage options in the country – and strengthen consumer protections. These changes apply to all policies issued or renewed after July 1st, 2020. Here at Provision, we pride ourselves on being insurance experts – so you don’t have to be. If you have questions about auto reform and how this new legislation may impact your auto policy, contact a member of our staff today!

To learn more, please view the following from our carrier partner, AAA (click to open).

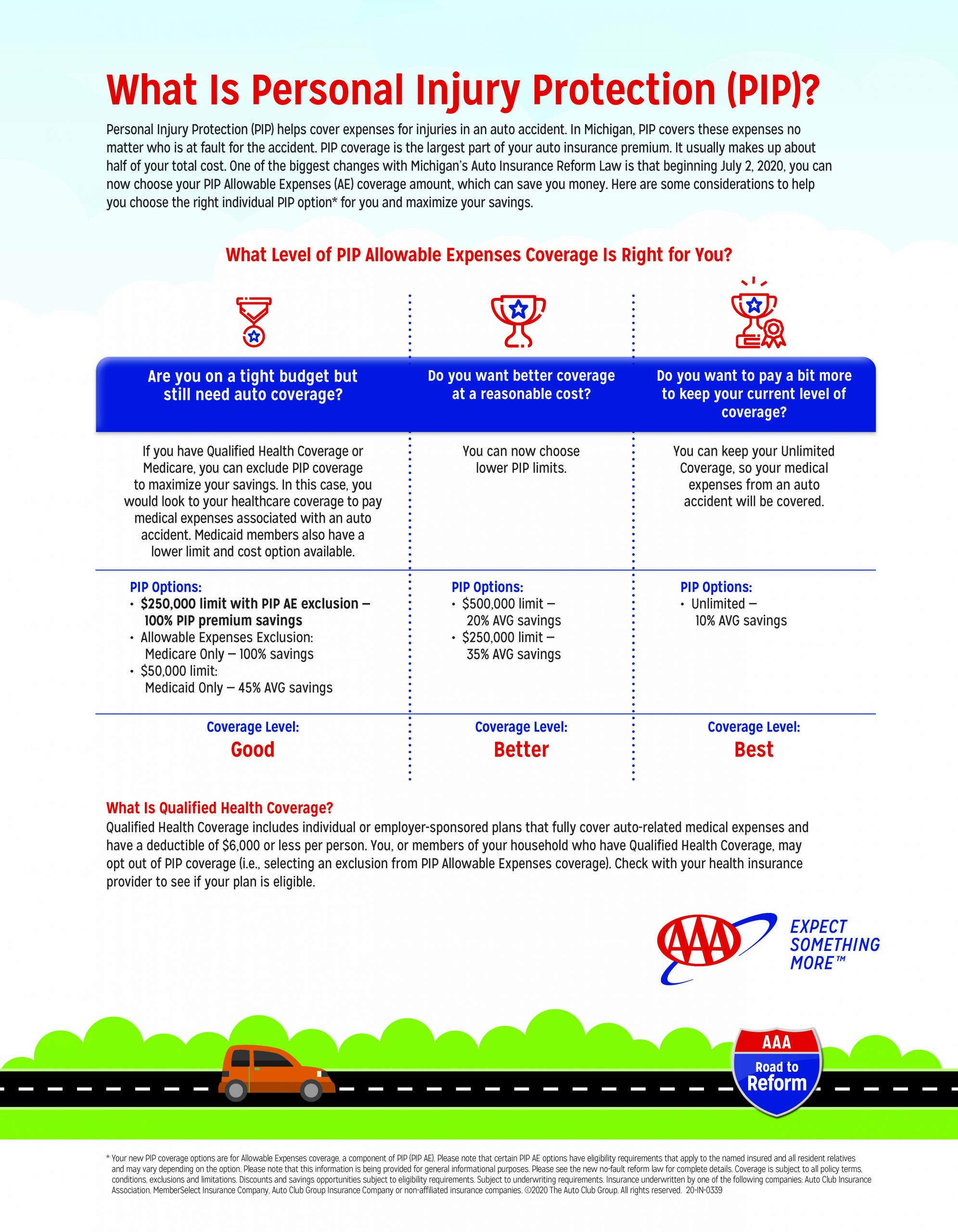

Personal Injury Protection (PIP) Overview

To learn more, please view the following from our carrier partner, AAA (click to open).

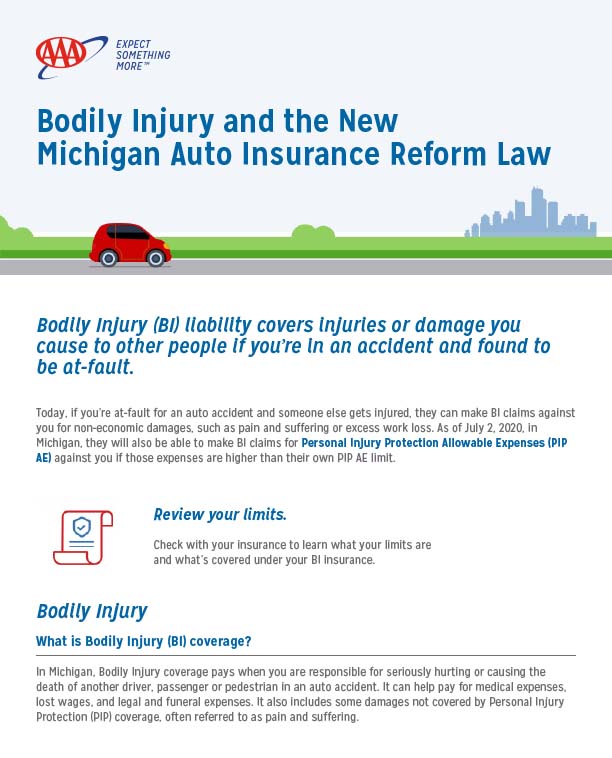

Bodily Injury (BI) Changes Overview

To learn more, please view the following from our carrier partner, AAA (click to open).

Qualified Health Review

To learn more, please view the following from our carrier partner, AAA (click to open).

Provision Insurance Can Help!

Contact Us

Customer Service

Provision Insurance Group

30200 Telegraph Road

Suite 350

Bingham Farms, MI 48025

Directions >

P: 248-262-7362

F: 248-250-5535

Everything You Need to Know About Michigan Auto Insurance Reform

MI Auto Insurance Reform Overview

The State of Michigan passed historic bipartisan auto no-fault legislation to lower costs for Michigan drivers – while maintaining the highest coverage options in the country – and strengthen consumer protections. These changes apply to all policies issued or renewed after July 1st, 2020. Here at Provision, we pride ourselves on being insurance experts – so you don’t have to be. If you have questions about auto reform and how this new legislation may impact your auto policy, contact a member of our staff today!

To learn more, please view the following from our carrier partner, AAA (click to open).

Personal Injury Protection (PIP) Overview

To learn more, please view the following from our carrier partner, AAA (click to open).

Bodily Injury (BI) Changes Overview

To learn more, please view the following from our carrier partner, AAA (click to open).

Qualified Health Review

To learn more, please view the following from our carrier partner, AAA (click to open).

Provision Insurance Can Help!

Contact Us

Customer Service

Provision Insurance Group

30200 Telegraph Road

Suite 350

Bingham Farms, MI 48025

Directions >

P: 248-262-7362

F: 248-250-5535

What our clients are saying

Provision's online reviews reflect our growing national reputation of excellence built by consistently providing great coverage, great rates, and stellar customer service.